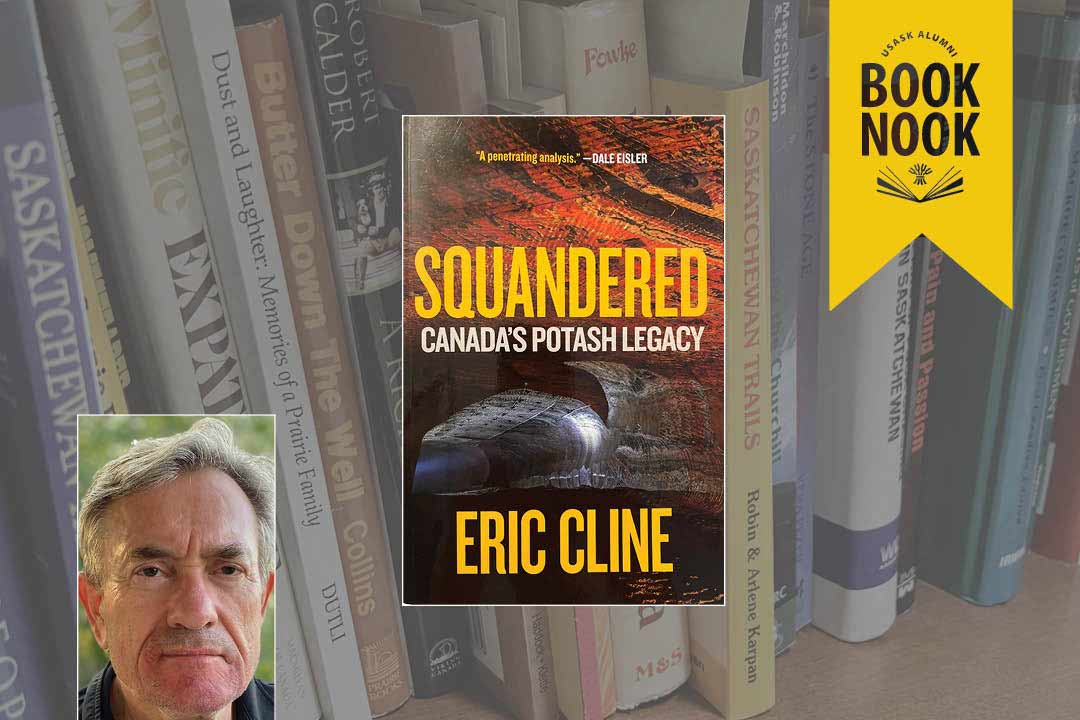

Alumni Book Nook: Eric Cline (BA’76, LLB’79)

Eric Cline is the author of the new book "Squandered: Canada’s Potash Legacy", which explores potash and profits in the province of Saskatchewan

University of Saskatchewan (USask) graduate Eric Cline practiced law in Saskatoon before serving for 16 years in the provincial legislature, taking on senior cabinet positions in finance, industry and resources, and health. After leaving politics, he worked as a corporate executive in the mining sector before establishing an arbitration practice. In 2008, his first book—Making a Difference: Reflections from Public Life—was published. Cline continues to live and write in Saskatoon and to work as a professional glass artist.

Please set the scene for people who may be unfamiliar with potash provincially, nationally, and globally. What is unique about potash in Saskatchewan?

Saskatchewan is unique when it comes to its potash resource for several reasons. Firstly, the province has a vast amount of potash, one-third of the known world reserves. Secondly, unlike other places, the potash is in a relatively level and thick seam, running through the province, which makes it accessible for mining, and qualifies it as a potash reserve. Thirdly, Saskatchewan potash is high quality compared to potash in other jurisdictions. Finally, mining in Saskatchewan is cost effective compared to other parts of the world.

What makes potash such an important and valuable resource?

World population is rising. The amount of arable land per person has been falling for decades. Therefore, fertilizer is a very valuable commodity and will continue to be so. Potash is a necessary ingredient of fertilizer. Therefore, it is likely to maintain its value and increase in value, as it has been doing over the last few decades.

What are the historical factors that have led to the current situation in Saskatchewan?

The potash industry was built up in Saskatchewan from the late 1950s to the end of the 1960s and expanded in the period from 2005 to the present time. The industry made a good rate of return over the years and has always contributed positively to the provincial economy. Beginning in 2008, when the price of a metric tonne of potash nearly tripled, the industry began to take in what could be considered windfall profits because they resulted from an increase in world price alone, not from investment or risk taking. For example, in 2008, profits from the price increase were $3 billion in addition to the already adequate rate of return the companies were making. The tax and royalty system in place in Saskatchewan has never anticipated the level of profit that they’re now, and the bulk of the benefit from increased value of potash goes to the companies. The book argues that the windfall profits should go to the public as owner of the resource because the price reflects the value of the potash it is selling to the companies. Recovery of windfall profits was the approach taken by Premiers Lougheed and Blakeney in the 1970s when the world price of oil doubled. Since 2008, the price of potash has increased to levels never anticipated. For example, in 2022, windfall profits amounted to $7.2 billion, of which the province recovered $1.4 billion dollars, leaving $5.8 billion for the companies.

What policy options do you advocate in your book?

I advocate that the advice of Jack Mintz of the University of Calgary’s School of Public Policy be followed. He is one of the world’s leading resource tax economists and well respected nationally and internationally. He proposes an economic rent model, whereby the industry is entitled to a reasonable rate of return, and profits above that belong to the public as owner of the resource. This is a known model. Essentially, it means that the public share would go up as profits go up and down in times of low profit. He would also advocate that there is a base level of public revenue for stability of public finance, with the industry recovering any overpayment in line years when profits return to higher levels.

I’m not qualified to say what a reasonable rate of return to the companies would be. We do know that in 2007, when the price was $270 per tonne, the PCS Annual Report stated the company was “thriving.” The companies were quite profitable prior to the dramatic price increases beginning in 2008. I raised the possibility of a public inquiry, transparent and objective, to look into the costs of producing potash and assert that if the Government of Saskatchewan and the potash producers believe that the present level of profit is justifiable, they should have no objection to such a process.

You are a former Saskatchewan cabinet minister who spent several years as the minister of industry and resources. How did your time serving the people of Saskatchewan shape your views on potash in the province?

One of the things I learned in government is that you have to make choices. When you choose to favour one area of programming, or one segment of the economy, you are also making the choice to give priority to another area of programming or other sectors of the economy. The potash companies paid, by far, the lowest marginal effective tax rate of any industry in Saskatchewan. When the taxes of companies are kept very low, it means more public debt, more consumption taxes on ordinary people and small business, and higher tax rates for other industries on the public generally. It also may mean inadequate public funding of education or health care or support for vulnerable people. The answer to the question of what is the appropriate balance between corporate profit and the public share will directly impact Saskatchewan society and, given the size of the industry, will determine whether the province continues on a path of a growing divide between the wealthy and the desperately poor, or pursues equality of opportunity and provides training and other supports to prepare future generations for successful lives.

What inspires you to write about politics and current affairs?

I was inspired to write this book because the potash story and the revenue situation as I have described it above is not discussed either in the media or the legislature and people don’t know about it. My first priority is to inform the public in a factual way that allows them to arrive at their conclusions. I hope that public debate will follow that and ultimately there will be positive change.

What response has your book received so far?

In the three weeks following the release of the book, there has been considerable interest in the media and a good level of interest in the book. It was the bestseller for non-fiction at McNally Robinson (in) Saskatoon for some time. Book launches in Saskatoon and Regina were well attended. Comments from people who have read the book have all been very positive, with people saying there is a lot of information in the book they were not aware of and appreciate knowing.

Is there anything else that you would like to add?

Although I was an NDP member of the legislature, I want people to know that experts from a conservative perspective, such as Jack Mintz, a former board member of Imperial Oil, and from a social democratic perspective, such as former NDP Member of Parliament and economist Erin Weir, have called for an urgent reform of Saskatchewan’s tax and royalty system. You don’t have to be a social democrat to believe that the public is entitled to a fair return from the sale of its resources. My loyalty to my province is greater than any loyalty I have to a political party, and the issue transcends partisan politics.